In Solutions / Enterprise Vertical Opportunities

Fintech: Protect, Optimize, and Scale Financial Innovation

Mobileum enables Fintech organizations to achieve operational resilience, real-time fraud protection, and compliance assurance through AI-driven risk management, telecom-grade analytics, and digital ecosystem assurance.

Navigating the Complexity of Fintech Risk and Compliance

Surging Digital Fraud Risks: Over $48 billion in global fraud losses forecasted by 2025, driven by instant payments and digital wallets

Growing Regulatory Pressures: Fintech's must comply with evolving financial regulations, PSD2, GDPR, and real-time transaction monitoring requirements

Operational Resilience Demands: 73% of fintech companies struggle to detect system failures proactively across complex, hybrid infrastructures

Empowering Fintech with Telco Grade Intelligence

Mobileum's Fintech solutions integrate telecom-grade intelligence with real-time fintech operations, ensuring security, optimization andfinancial compliance services in a mobile-first, digital economy.

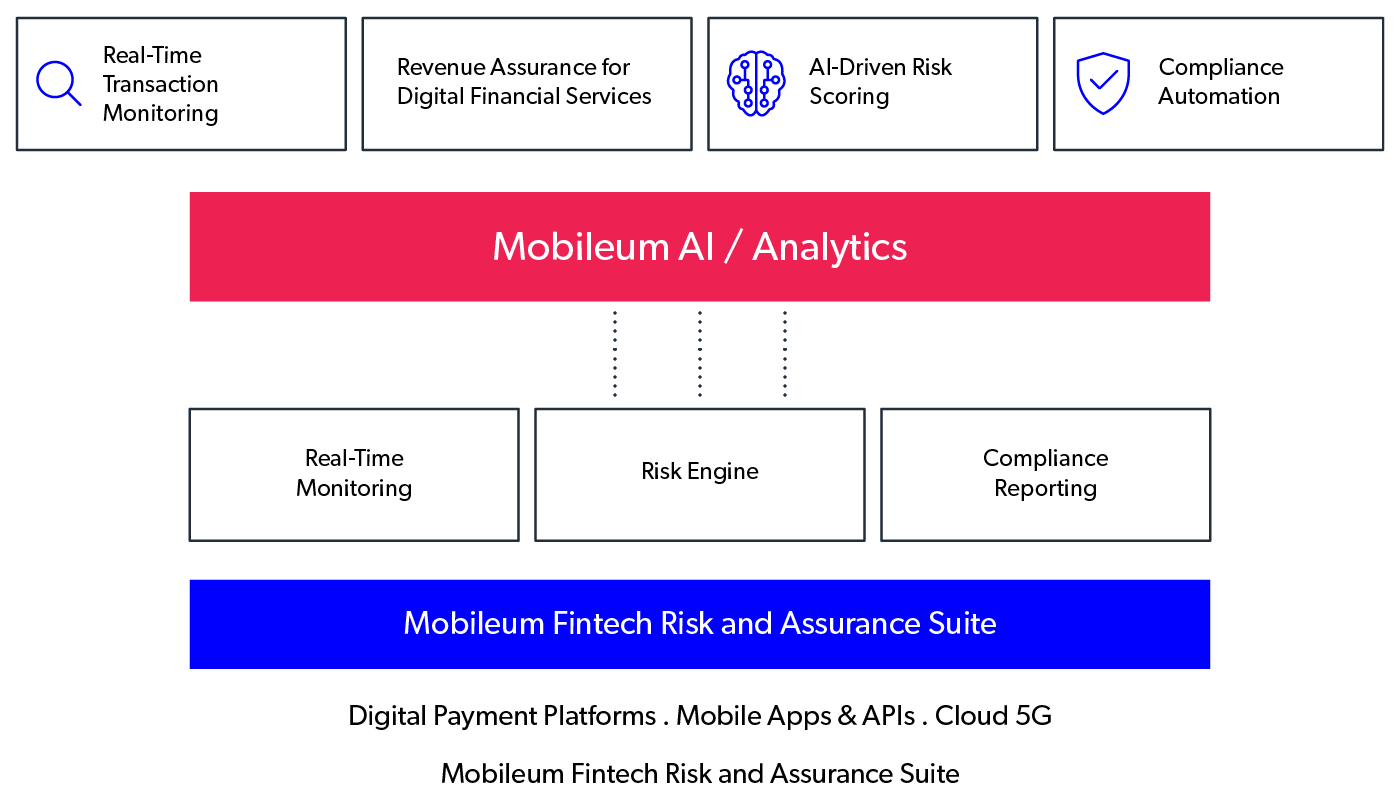

Key Capabilities

- Real-Time Transaction Monitoring: Detect fraudulent, anomalous, or suspicious transactions across digital payment platforms

- Revenue Assurance for Digital Financial Services: Prevent revenue leakage and assure compliance in mobile money, neobanks, and digital wallet ecosystems

- AI-Driven Risk Scoring: Automate transaction risk evaluation, fraud scoring, and user behavior analytics

- Compliance Automation: Streamline audits, regulatory reporting (AML, KYC, PSD2), and real-time controls with minimal manual intervention

Business Outcomes

Trusted Service Delivery

Assure continuous service availability, transaction integrity, and compliance across mobile apps, APIs, cloud, and 5G networks.

Stop Fraud, Prevent Revenue

Leverage AI-powered monitoring and anomaly detection to prevent financial loss, data breaches, and transaction fraud.

Simplify Compliance, Minimize Risk

Simplify real-time audits, compliance reporting, and risk scoring across complex payment and financial ecosystems with AI-driven automation.

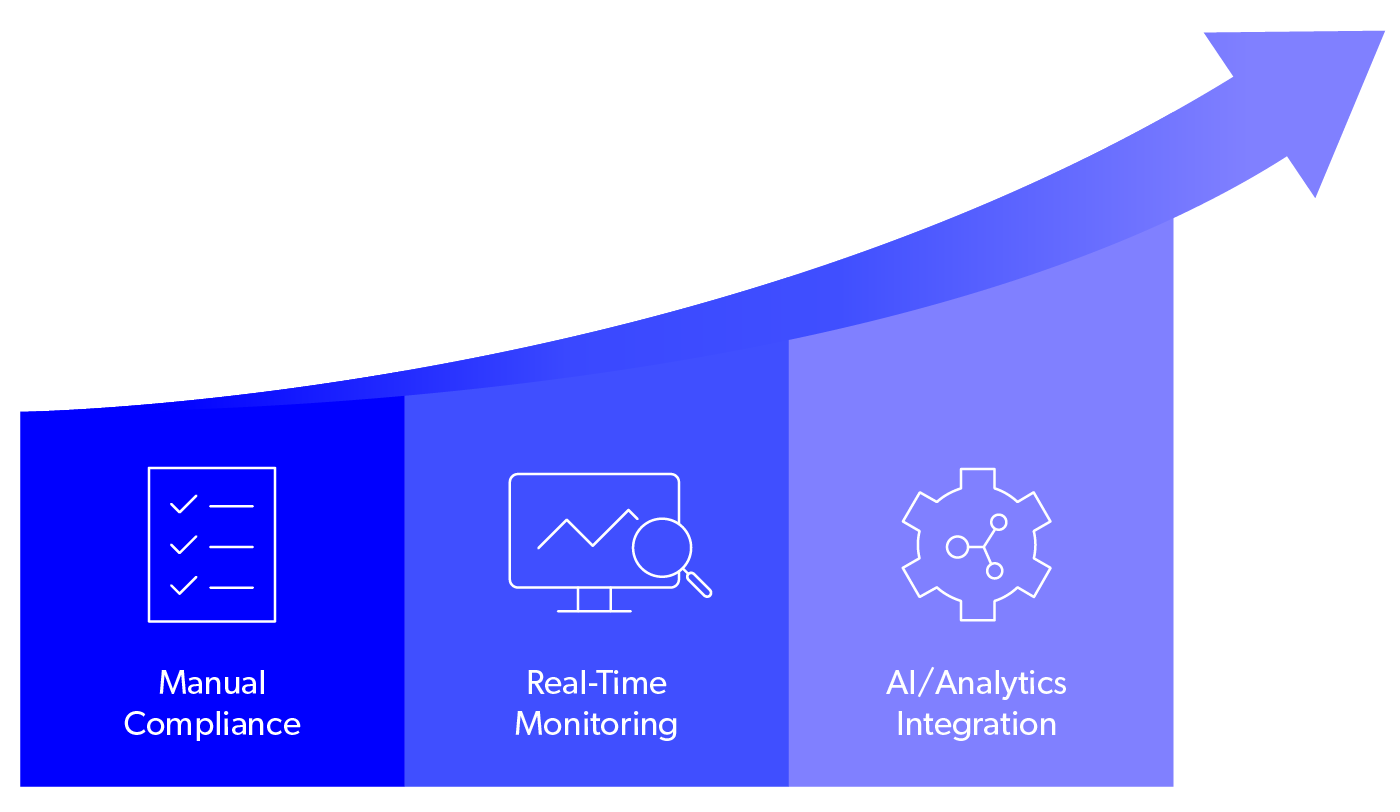

Your Transformation Journey

From reactive risk management to real-time AI-powered intelligence driven assurance – Mobileum empowers Fintech's to build resilient, agile, and trusted digital finance ecosystems.

Why Mobileum

-

Global Leader:

Trusted by 1,000+ operators across 190+ countries

-

All-in-One Intelligence:

Unifies data to turn insights into real-time actions

-

Proven AI Performance:

Purpose-built AI to detect threats and boost performance

-

Ready for What’s Next:

Powering 5G, IoT, and new revenue streams